Regulatory Review Course California Cpa

Regulatory Review Course California Cpa - It includes a review of current the california accountancy act and the current california board of. This course reviews the california accountancy act and california board of accountancy regulations specific to practicing accounting in california. The next regulatory review course due date is listed to the right of the license expiration date on part a of the license renewal application. As of july 1, 2024, it replaces the. Recognize disciplinary issues frequently encountered by. This course fulfills cba criteria for initial cpa licensure in california. Download pdf materials, take an online test, and earn cpe credit. Apply the aicpa code and california laws for cpa compliance. This course provides california licensees an understanding of provisions of the california accountancy act and the board of accountancy regulations specific to the practice of public. Accountancy act, rules and regulations is a course that fulfills this requirement for california cpas. This course provides california licensees an understanding of provisions of the california accountancy act and the board of accountancy regulations specific to the practice of public. Accountancy act, rules and regulations is a course that fulfills this requirement for california cpas. The next regulatory review course due date is listed to the right of the license expiration date on part a of the license renewal application. Multiple business tracksmaster's degree programsbachelor degree programs Recognize disciplinary issues frequently encountered by. This course reviews the california accountancy act and california board of accountancy regulations specific to practicing accounting in california. This course fulfills cba criteria for initial cpa licensure in california. As of july 1, 2024, it replaces the. Determine actions that align with ethical intent, not. It includes a review of current the california accountancy act and the current california board of. Apply the aicpa code and california laws for cpa compliance. It is designed for california cpas to meet the 2 hour regulatory review requirement. It includes a review of current the california accountancy act and the current. Multiple business tracksmaster's degree programsbachelor degree programs As of july 1, 2024, it replaces the. This course provides california licensees an understanding of provisions of the california accountancy act and the board of accountancy regulations specific to the practice of public. Instant accessfree sample courseaccepted all 50 states Describe professional laws, rules, and regulations required for accounting licensure by the california board of accountancy; As of july 1, 2024, it replaces the. It is designed. Multiple business tracksmaster's degree programsbachelor degree programs Identify standards of professional conduct; Accountancy act, rules and regulations is a course that fulfills this requirement for california cpas. As of july 1, 2024, it replaces the. Apply the aicpa code and california laws for cpa compliance. It includes a review of current the california accountancy act and the current california board of. Interpret california statutes, rules, and policies governing cpa conduct. Workforce welcome100% onlinedigital materialsflexible program length Accountancy act, rules and regulations is a course that fulfills this requirement for california cpas. Recognize disciplinary issues frequently encountered by. The next regulatory review course due date is listed to the right of the license expiration date on part a of the license renewal application. It also discusses actions that have. Download pdf materials, take an online test, and earn cpe credit. Determine actions that align with ethical intent, not. Accountancy act, rules and regulations is a course that fulfills. It includes a review of current the california accountancy act and the current. Describe professional laws, rules, and regulations required for accounting licensure by the california board of accountancy; It is designed for california cpas to meet the 2 hour regulatory review requirement. Recognize important sections of the california board of accountancy regulations; It includes a review of current the. Describe professional laws, rules, and regulations required for accounting licensure by the california board of accountancy; This course provides california licensees an understanding of provisions of the california accountancy act and the board of accountancy regulations specific to the practice of public. This course reviews the california accountancy act and california board of accountancy regulations specific to practicing accounting in. Download pdf materials, take an online test, and earn cpe credit. It is designed for california cpas to meet the 2 hour regulatory review requirement. Workforce welcome100% onlinedigital materialsflexible program length Recognize important sections of the california board of accountancy regulations; This course reviews the california accountancy act and california board of accountancy regulations specific to practicing accounting in california. It includes a review of current the california accountancy act and the current. Accountancy act, rules and regulations is a course that fulfills this requirement for california cpas. It includes a review of current the california accountancy act and the current california board of. Determine actions that align with ethical intent, not. Describe professional laws, rules, and regulations required for. Workforce welcome100% onlinedigital materialsflexible program length Multiple business tracksmaster's degree programsbachelor degree programs In order for california cpa’s to maintain a license in an active status, the california board of accountancy (cba) requires that cpa’s complete a board approved regulatory review. This course provides california licensees an understanding of provisions of the california accountancy act and the board of accountancy. Interpret california statutes, rules, and policies governing cpa conduct. It is designed for california cpas to meet the 2 hour regulatory review requirement. Accountancy act, rules and regulations is a course that fulfills this requirement for california cpas. The next regulatory review course due date is listed to the right of the license expiration date on part a of the license renewal application. It also discusses actions that have. In order for california cpa’s to maintain a license in an active status, the california board of accountancy (cba) requires that cpa’s complete a board approved regulatory review. Workforce welcome100% onlinedigital materialsflexible program length Apply the aicpa code and california laws for cpa compliance. It includes a review of current the california accountancy act and the current california board of. This course fulfills cba criteria for initial cpa licensure in california. Recognize important sections of the california board of accountancy regulations; Download pdf materials, take an online test, and earn cpe credit. This course reviews the california accountancy act and california board of accountancy regulations specific to practicing accounting in california. Instant accessfree sample courseaccepted all 50 states Describe professional laws, rules, and regulations required for accounting licensure by the california board of accountancy; This course provides california licensees an understanding of provisions of the california accountancy act and the board of accountancy regulations specific to the practice of public.Form CERR1 Fill Out, Sign Online and Download Printable PDF

In California do I need the two hour board approved regulatory review

California Regulatory Review Western CPE

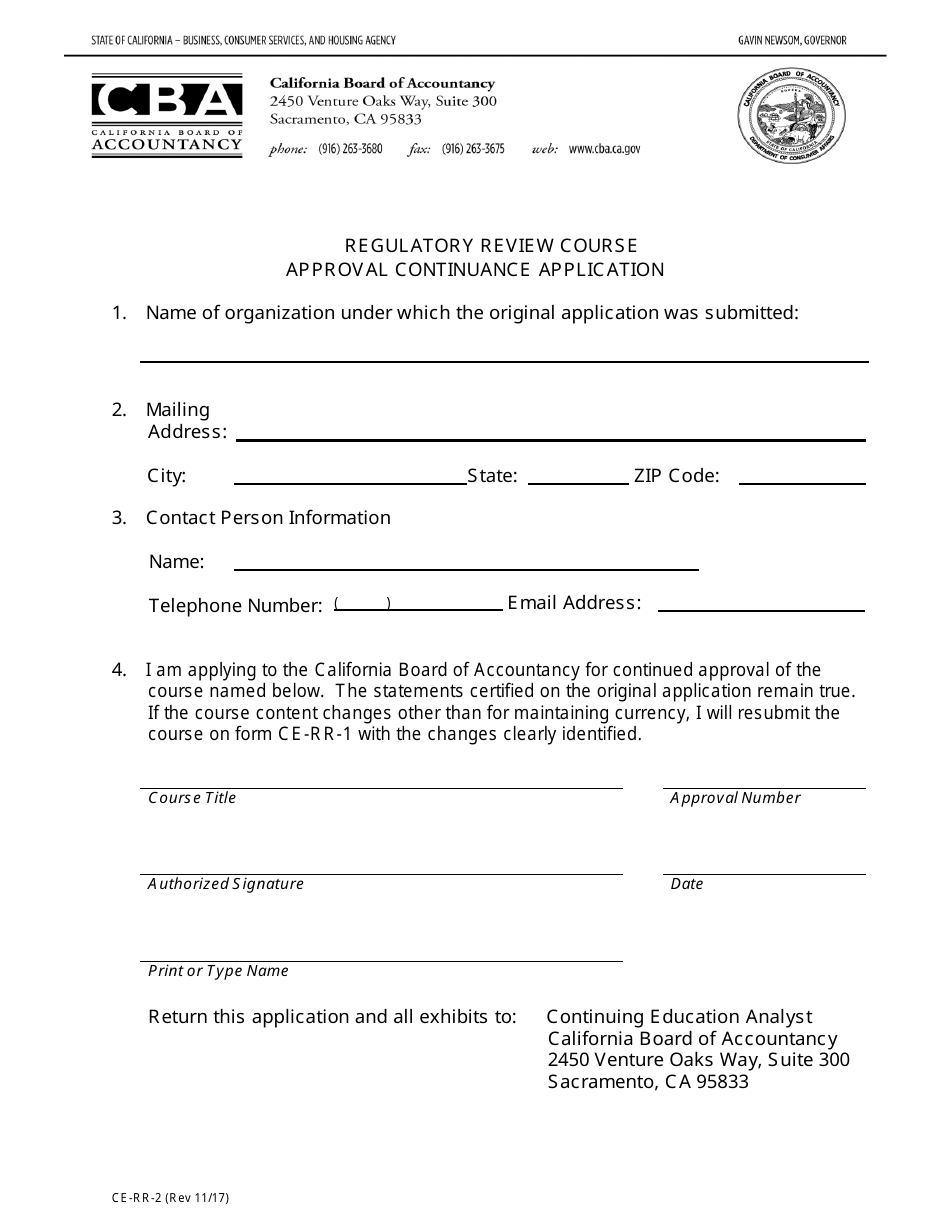

Form CERR2 Fill Out, Sign Online and Download Printable PDF

REG CPA Exam Study Guide Universal CPA Review

Best CPA Review Courses in California, Florida, New York & More [2023]

CPA Regulation Exam Secrets, Study Guide CPA Test Review for the Cer…

California Regulatory Review Accountancy Act, Rules and Regulations

Once you're a CPA...

New regulatory review requirement for CA CPA licensure

Determine Actions That Align With Ethical Intent, Not.

Multiple Business Tracksmaster's Degree Programsbachelor Degree Programs

This Course Provides California Licensees An Understanding Of Provisions Of The California Accountancy Act And The Board Of Accountancy Regulations Specific To The Practice Of Public.

It Includes A Review Of Current The California Accountancy Act And The Current.

Related Post:

![Best CPA Review Courses in California, Florida, New York & More [2023]](https://www.accountingcareerguide.com/wp-content/uploads/2019/11/Best-CPA-Review-Courses-Accounting-Career-Guide-930x620.png)