How Much Does Defensive Driving Course Lower Insurance

How Much Does Defensive Driving Course Lower Insurance - Some states require insurance companies to offer a. It allows reductions to rates and premium charges for automobile liability insurance for any insured driver over age 55 upon successful completion of the national safety council's. A defensive driving discount is a. How much do speeding tickets affect insurance? To qualify for a defensive driver car. The answer is that it depends! Often, illinois car insurance providers will offer a safe driver discount on premiums to drivers who voluntarily complete a defensive driving course. Teens and seniors are often eligible for the discount, which can lower premiums by around 10%. Insurance companies often view speeding violations as indicators of risky. Thus, they reward safe drivers with lower premiums. In illinois, a speeding ticket can lead to increased insurance premiums and potentially impact your driving record. What is a defensive driving discount? Teens and seniors are often eligible for the discount, which can lower premiums by around 10%. The discount varies but usually falls in the range of 5% to 20% off your. Often, illinois car insurance providers will offer a safe driver discount on premiums to drivers who voluntarily complete a defensive driving course. Some states require insurance companies to offer a. Many insurance providers offer significant auto insurance discounts if you complete a defensive driving course. A defensive driving course typically lasts six to eight hours. A defensive driving discount is a. Not only does defensive driving help you stay safe, but it. Lower stress levels and avoid road rage; Completing a defensive driving course can lead to substantial financial benefits. Beyond savings, the course equips you with. How much do speeding tickets affect insurance? To qualify for a defensive driver car. Many insurance providers offer significant auto insurance discounts if you complete a defensive driving course. The answer is that it depends! A defensive driving discount is a. Some states require insurance companies to offer a. A defensive driving course typically lasts six to eight hours. Not only does defensive driving help you stay safe, but it. 5/5 (6,525 reviews) In illinois, a speeding ticket can lead to increased insurance premiums and potentially impact your driving record. Some states require insurance companies to offer a. Car insurance providers don’t want to pay claims if they don’t have to. A defensive driving discount is a. While discounts vary by state and insurance provider, here’s what drivers typically receive:. Thus, they reward safe drivers with lower premiums. So, does defensive driving lower insurance? Lower stress levels and avoid road rage; Drivers can typically save between 5% and 20% on their car insurance rates with a defensive driving course discount. It allows reductions to rates and premium charges for automobile liability insurance for any insured driver over age 55 upon successful completion of the national safety council's. A defensive driving course typically lasts six to eight hours. To qualify for a. Lower stress levels and avoid road rage; Many insurance providers offer significant auto insurance discounts if you complete a defensive driving course. While discounts vary by state and insurance provider, here’s what drivers typically receive:. Often, illinois car insurance providers will offer a safe driver discount on premiums to drivers who voluntarily complete a defensive driving course. Car insurance providers. Teens and seniors are often eligible for the discount, which can lower premiums by around 10%. Drive safely in bad weather; Car insurance providers don’t want to pay claims if they don’t have to. It allows reductions to rates and premium charges for automobile liability insurance for any insured driver over age 55 upon successful completion of the national safety. 5/5 (6,525 reviews) We always recommend checking with your insurance provider to confirm the discount you can. What is a defensive driving discount? Drivers can typically save between 5% and 20% on their car insurance rates with a defensive driving course discount. A defensive driving course typically lasts six to eight hours. Drive safely in bad weather; Many insurance providers offer significant auto insurance discounts if you complete a defensive driving course. Some states require insurance companies to offer a. So, does defensive driving lower insurance? 5/5 (6,525 reviews) Drive safely in bad weather; To qualify for a defensive driver car. Beyond savings, the course equips you with. Completing a defensive driving course can lead to significant savings on your auto insurance premiums. Lower stress levels and avoid road rage; In illinois, a speeding ticket can lead to increased insurance premiums and potentially impact your driving record. Beyond savings, the course equips you with. While discounts vary by state and insurance provider, here’s what drivers typically receive:. What is a defensive driving discount? The answer is that it depends! To qualify for a defensive driver car. We always recommend checking with your insurance provider to confirm the discount you can. Teens and seniors are often eligible for the discount, which can lower premiums by around 10%. The discount varies but usually falls in the range of 5% to 20% off your. Learn how to get a defensive driver auto insurance discount of up to 10%, potentially saving you $36/mo on your premiums. How much do speeding tickets affect insurance? It allows reductions to rates and premium charges for automobile liability insurance for any insured driver over age 55 upon successful completion of the national safety council's. Thus, they reward safe drivers with lower premiums. Not only does defensive driving help you stay safe, but it. A defensive driving discount is a. Many insurance providers offer significant auto insurance discounts if you complete a defensive driving course.Does Taking a Defensive Driving Course Lower Insurance?

Cost of Defensive Driving Classes What to Expect The Wiser Driver

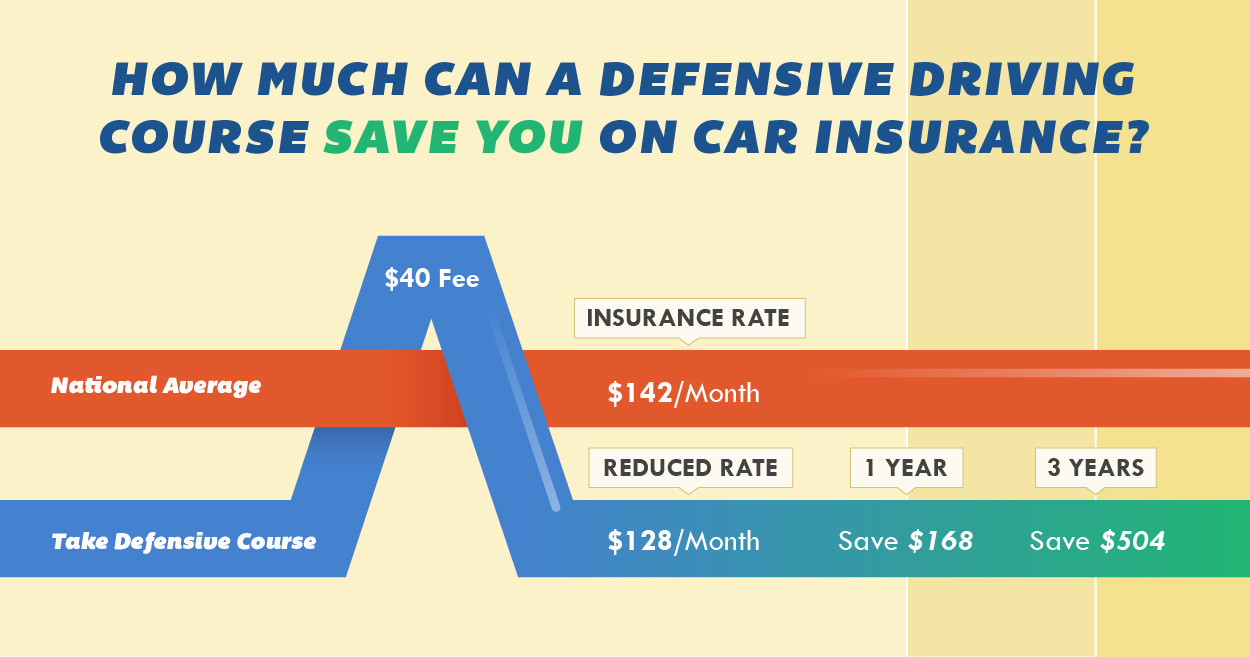

How Much Does a Defensive Driving Course Save on Insurance?

Are Defensive Driving Courses Worth the Money? QuoteWizard

How Much Does a Defensive Driving Course Save on Insurance?

Safe Driving Classes For Seniors Comparison + Details Traffic Safety

Save Money On Car Insurance Defensive Driving Course From Debt To

How to Reduce Your Florida Insurance Premium with Defensive Driving

Cost of Defensive Driving Classes What to Expect The Wiser Driver

Does a defensive driving course lower your insurance costs?

Drivers Can Typically Save Between 5% And 20% On Their Car Insurance Rates With A Defensive Driving Course Discount.

Some States Require Insurance Companies To Offer A.

5/5 (6,525 Reviews)

Completing A Defensive Driving Course Can Lead To Substantial Financial Benefits.

Related Post: