Gaap Online Course

Gaap Online Course - To pass the any examinations or do well in corporate, it is very. Get fee details, duration and read reviews of. In this course, we will delve deep into the intricacies of us. We can deliver bespoke us gaap training courses. Federal income tax system in this online accounting course. Up to 10% cash back this course is intended to provide a detailed understanding of the key us gaap concepts spread across 41 lectures in a quick and easy manner. Our comprehensive us gaap training program offers a global perspective, recognizing the increasing interconnectedness of financial markets and the growing importance of international. Us based companies are required to follow the us generally accepted accounting principles (us gaap) issued by the financial accounting standards board (fasb). Want to gain a solid understanding of the unique. Up to 10% cash back this mini course is designed to help you understand the important concepts of us gaap. Want to gain a solid understanding of the unique. Look no further than our online libraries! Current position from fasb on convergence. Topics include revenue (“606”) recognition guidance and new leases (“842”). Get a comprehensive introduction to the u.s. Take a deep dive into the operating practices, accounting methodology, and regulatory environment of the insurance industry. Federal income tax system in this online accounting course. Us based companies are required to follow the us generally accepted accounting principles (us gaap) issued by the financial accounting standards board (fasb). We can deliver bespoke us gaap training courses. Up to 10% cash back this course is intended to provide a detailed understanding of the key us gaap concepts spread across 41 lectures in a quick and easy manner. See details like eligibility, fee, how to apply, syllabus, duration, and more on careers360 Up to 10% cash back this course is intended to provide a detailed understanding of the key us gaap concepts spread across 41 lectures in a quick and easy manner. Our comprehensive us gaap training program offers a global perspective, recognizing the increasing interconnectedness of financial. Look no further than our online libraries! Get a comprehensive introduction to the u.s. Up to 10% cash back this course is intended to provide a detailed understanding of the key us gaap concepts spread across 41 lectures in a quick and easy manner. Take a deep dive into the operating practices, accounting methodology, and regulatory environment of the insurance. Take a deep dive into the operating practices, accounting methodology, and regulatory environment of the insurance industry. Look no further than our online libraries! See details like eligibility, fee, how to apply, syllabus, duration, and more on careers360 Current position from fasb on convergence. Topics include revenue (“606”) recognition guidance and new leases (“842”). See details like eligibility, fee, how to apply, syllabus, duration, and more on careers360 Concepts covered include gross income, deductions and tax computations for. We can deliver bespoke us gaap training courses. Learn about us gaap changes via our online training course. Enroll for certified us gaap professional course by vskills online & get a certificate. To pass the any examinations or do well in corporate, it is very. Get fee details, duration and read reviews of. Up to 10% cash back this course is intended to provide a detailed understanding of the key us gaap concepts spread across 41 lectures in a quick and easy manner. Enroll for certified us gaap professional course by vskills. Us based companies are required to follow the us generally accepted accounting principles (us gaap) issued by the financial accounting standards board (fasb). Get a comprehensive introduction to the u.s. Up to 10% cash back this course is intended to provide a detailed understanding of the key us gaap concepts spread across 41 lectures in a quick and easy manner.. Topics include revenue (“606”) recognition guidance and new leases (“842”). Current position from fasb on convergence. Federal income tax system in this online accounting course. We can deliver bespoke us gaap training courses. In this course, we will delve deep into the intricacies of us. Federal income tax system in this online accounting course. Get fee details, duration and read reviews of. Topics include revenue (“606”) recognition guidance and new leases (“842”). In this program, ey professionals and senior industry experts will share perspective on the us gaap including accounting standards codification (asc). Concepts covered include gross income, deductions and tax computations for. Our comprehensive us gaap training program offers a global perspective, recognizing the increasing interconnectedness of financial markets and the growing importance of international. We can deliver bespoke us gaap training courses. Up to 10% cash back this mini course is designed to help you understand the important concepts of us gaap. Enroll for certified us gaap professional course by vskills. Enroll for certified us gaap professional course by vskills online & get a certificate. Our comprehensive us gaap training program offers a global perspective, recognizing the increasing interconnectedness of financial markets and the growing importance of international. Up to 10% cash back welcome to our comprehensive course on us generally accepted accounting principles (gaap). See details like eligibility, fee, how. In this course, we will delve deep into the intricacies of us. Learn about us gaap changes via our online training course. Topics include revenue (“606”) recognition guidance and new leases (“842”). Current position from fasb on convergence. Up to 10% cash back welcome to our comprehensive course on us generally accepted accounting principles (gaap). Learn certificate program in us gaap by ernst & young course/program online & get a certificate on course completion from ey. Up to 10% cash back this mini course is designed to help you understand the important concepts of us gaap. Enroll for certified us gaap professional course by vskills online & get a certificate. Get a comprehensive introduction to the u.s. Up to 10% cash back this course is intended to provide a detailed understanding of the key us gaap concepts spread across 41 lectures in a quick and easy manner. Us based companies are required to follow the us generally accepted accounting principles (us gaap) issued by the financial accounting standards board (fasb). Look no further than our online libraries! Us based companies are required to follow the us generally accepted accounting principles (us gaap) issued by the financial accounting standards board (fasb). Federal income tax system in this online accounting course. To pass the any examinations or do well in corporate, it is very. In this program, ey professionals and senior industry experts will share perspective on the us gaap including accounting standards codification (asc).GAAP Online Training Resources YouTube

GAAP Tax Basis Overview online CPE Course • JN CPE

US GAAP Course (12 Courses Bundle, Online Certification)

Live Online US GAAP Classes I Diploma In IFRS AKPIS CPA CMA IFRS ACCA

Online Course Accounting Foundations Understanding the GAAP

GAAP Vs IFRS Similarities and Differences Syntrofia

What is GAAP? Know GAAP Skills, Career Path, Eligibility & Courses

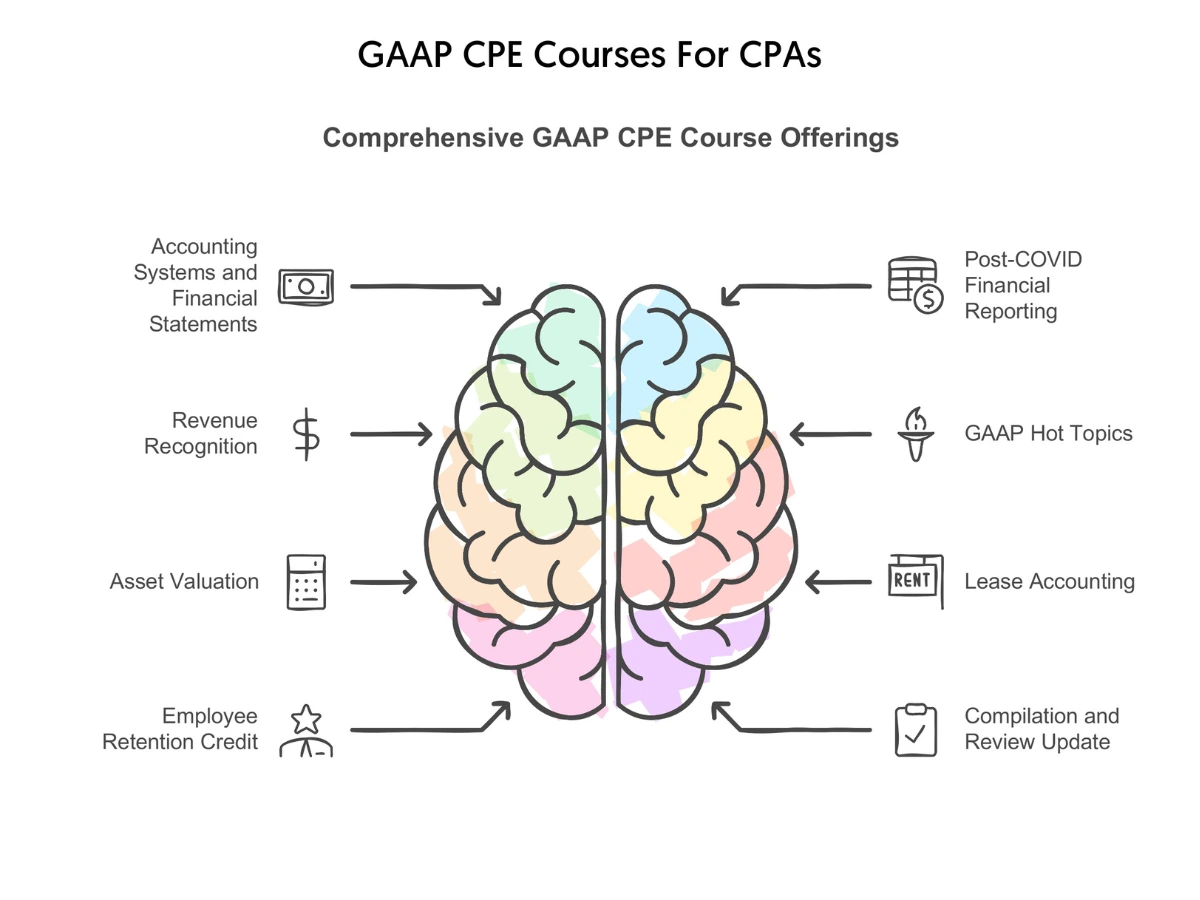

GAAP CPE Course GAAP Online Training Courses CPE Think

[Download Now] Interpreting NonGAAP Reports IMCourse Download

New Online Accounting and Auditing Courses (4Q24) GAAP Dynamics

Take A Deep Dive Into The Operating Practices, Accounting Methodology, And Regulatory Environment Of The Insurance Industry.

Get Fee Details, Duration And Read Reviews Of.

See Details Like Eligibility, Fee, How To Apply, Syllabus, Duration, And More On Careers360

Many Businesses Face Particular Challenges With Specific Us Gaap Standards, Whether That Is Asc 606 Revenue Or Asc 842 Leases.

Related Post:

![[Download Now] Interpreting NonGAAP Reports IMCourse Download](https://imcourse.net/wp-content/uploads/2022/06/Matan-Feldman-Interpreting-Non-GAAP-Reports-.jpg)