Florida Cpe Courses

Florida Cpe Courses - Learn how to complete 80 hours of cpe in public accounting subjects or courses of study, including ethics and behavioral courses, to renew your cpa license in florida. Complete mandatory florida cpe for cpas. Courses selected should be relevant to the practice. To help judges satisfy this educational requirement, florida judiciary education currently presents a variety of. Continuing judicial education is mandatory in florida, by court rule. The 80 hours must include eight (8) hours of accounting and auditing, four (4) hours of board. Accountingtools offers online cpe courses. Welcome to our physical therapy clinical educator corner, a resource hub featuring various forms and tools to support clinical education and our clinical education excellence webinar. The ficpa offers hundreds of. Mastercpe offers online cpe courses for cpas in florida, a qas provider with sponsor number #112530. To help judges satisfy this educational requirement, florida judiciary education currently presents a variety of. Take your cpe from the largest provider in the state and stay on top of major issues affecting the cpa profession. Mastercpe offers online cpe courses for cpas in florida, a qas provider with sponsor number #112530. Learn how to complete 80 hours of cpe in public accounting subjects or courses of study, including ethics and behavioral courses, to renew your cpa license in florida. Learn from industry experts and access a large archive of webinars, courses and resources on. The florida (fl) cpe course list from surgent provides hundreds of continuing professional education (cpe) options for public accountants and other finance professionals that include a. Explore furthered's florida cpe courses focused in your area of interest. You will earn up to 16 cpe hours and have an opportunity to network with a wider variety of colleagues and. Take your cpe from the largest provider in the state and stay on top of major issues affecting the cpa profession. The ficpa offers hundreds of. Welcome to our physical therapy clinical educator corner, a resource hub featuring various forms and tools to support clinical education and our clinical education excellence webinar. Mastercpe offers online cpe courses for cpas in florida, a qas provider with sponsor number #112530. To help judges satisfy this educational requirement, florida judiciary education currently presents a variety of. A portion of. Try our courses risk freeaccepted in all 50 states24/7 customer service Lorman offers online and ondemand courses for cpas in florida to fulfill their cpe requirements. Continuing judicial education is mandatory in florida, by court rule. Explore furthered's florida cpe courses focused in your area of interest. A portion of this type course will include a review of chapters 455. Complete mandatory florida cpe for cpas. Welcome to our physical therapy clinical educator corner, a resource hub featuring various forms and tools to support clinical education and our clinical education excellence webinar. Learn from industry experts and access a large archive of webinars, courses and resources on. To help judges satisfy this educational requirement, florida judiciary education currently presents a. The ficpa offers hundreds of. Continuing judicial education is mandatory in florida, by court rule. Mastercpe offers online cpe courses for cpas in florida, a qas provider with sponsor number #112530. You will earn up to 16 cpe hours and have an opportunity to network with a wider variety of colleagues and. A portion of this type course will include. Learn more → discover the power. Continuing judicial education is mandatory in florida, by court rule. The ficpa offers hundreds of. Learn about the florida board of accountancy cpe requirements for cpas, including hours, topics, deadlines and providers. You will earn up to 16 cpe hours and have an opportunity to network with a wider variety of colleagues and. The 80 hours must include eight (8) hours of accounting and auditing, four (4) hours of board. Try our courses risk freeaccepted in all 50 states24/7 customer service Learn about the florida board of accountancy cpe requirements for cpas, including hours, topics, deadlines and providers. To help judges satisfy this educational requirement, florida judiciary education currently presents a variety of.. Regarding these 80 hours, you must also meet the following. Welcome to our physical therapy clinical educator corner, a resource hub featuring various forms and tools to support clinical education and our clinical education excellence webinar. To help judges satisfy this educational requirement, florida judiciary education currently presents a variety of. Accountingtools offers online cpe courses. Try our courses risk. Take your cpe from the largest provider in the state and stay on top of major issues affecting the cpa profession. Learn from industry experts and access a large archive of webinars, courses and resources on. Lorman offers online and ondemand courses for cpas in florida to fulfill their cpe requirements. Gain instant access to furthered's cpe courses for 10. Welcome to our physical therapy clinical educator corner, a resource hub featuring various forms and tools to support clinical education and our clinical education excellence webinar. Continuing judicial education is mandatory in florida, by court rule. Earn cpe without having to leave the office. The ficpa offers hundreds of. Gain instant access to furthered's cpe courses for 10 days. Learn about the cpe requirements, ethics, subjects, and contact info for florida cpas. Choose your courses and earn all the credits you need in one place with unlimited cpe from furthered cpe. Gain instant access to furthered's cpe courses for 10 days. Complete mandatory florida cpe for cpas. Regarding these 80 hours, you must also meet the following. Mastercpe offers online cpe courses for cpas in florida, a qas provider with sponsor number #112530. Learn about the cpe requirements, ethics, subjects, and contact info for florida cpas. Lorman offers online and ondemand courses for cpas in florida to fulfill their cpe requirements. You will earn up to 16 cpe hours and have an opportunity to network with a wider variety of colleagues and. Learn more → discover the power. Continuing judicial education is mandatory in florida, by court rule. The ficpa offers hundreds of. Choose your courses and earn all the credits you need in one place with unlimited cpe from furthered cpe. Regarding these 80 hours, you must also meet the following. To help judges satisfy this educational requirement, florida judiciary education currently presents a variety of. Learn how to complete 80 hours of cpe in public accounting subjects or courses of study, including ethics and behavioral courses, to renew your cpa license in florida. Gain instant access to furthered's cpe courses for 10 days. Accountingtools offers online cpe courses. Learn about the florida cpe requirements, categories, and guidelines for cpas. Courses selected should be relevant to the practice. The purpose of continuing professional education is to assist cpas in maintaining their professional knowledge and competence.Florida CAM Continuing Education Courses Online

7 Best Online CPE Courses for CPAs 2025 Miami Herald

Florida Electrical Continuing Education Courses 75

Florida CPE Requirements for CPAs Miami Herald

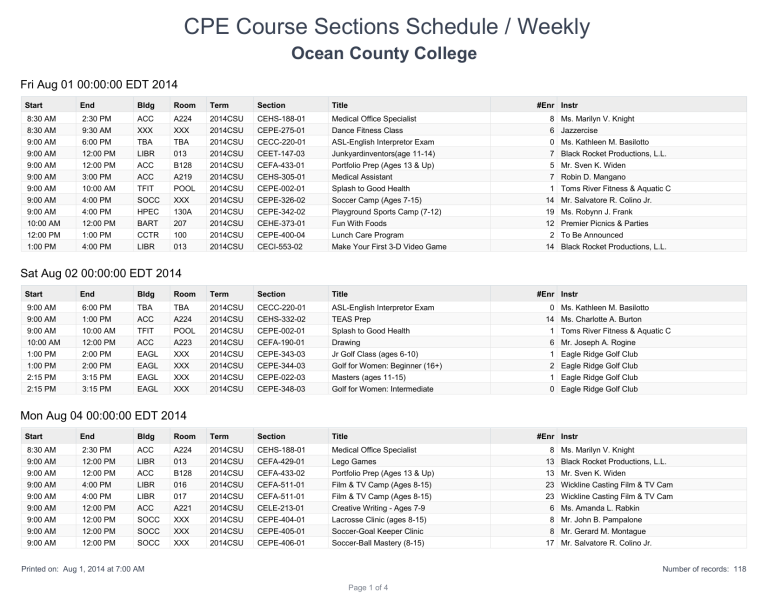

CPE Course Sections Schedule / Weekly

CPE Courses for CPAs Florida Ultimate CPE by Ultimatecpe on DeviantArt

Explore NASBAApproved CPE Ethics Courses by CPE Credit Professional

Online Cpe Courses For Cpe Florida Photograph by Ultimate Cpe Fine

Renuka Ghingoor on LinkedIn We are hosting an Virtual CPE course for

Florida CPE Ethics Courses from YouTube

The 80 Hours Must Include Eight (8) Hours Of Accounting And Auditing, Four (4) Hours Of Board.

You Will Earn Up To 16 Cpe Hours And Have An Opportunity To Network With A Wider Variety Of Colleagues And.

Try Our Courses Risk Freeaccepted In All 50 States24/7 Customer Service

Learn From Industry Experts And Access A Large Archive Of Webinars, Courses And Resources On.

Related Post: