Business Credit Course

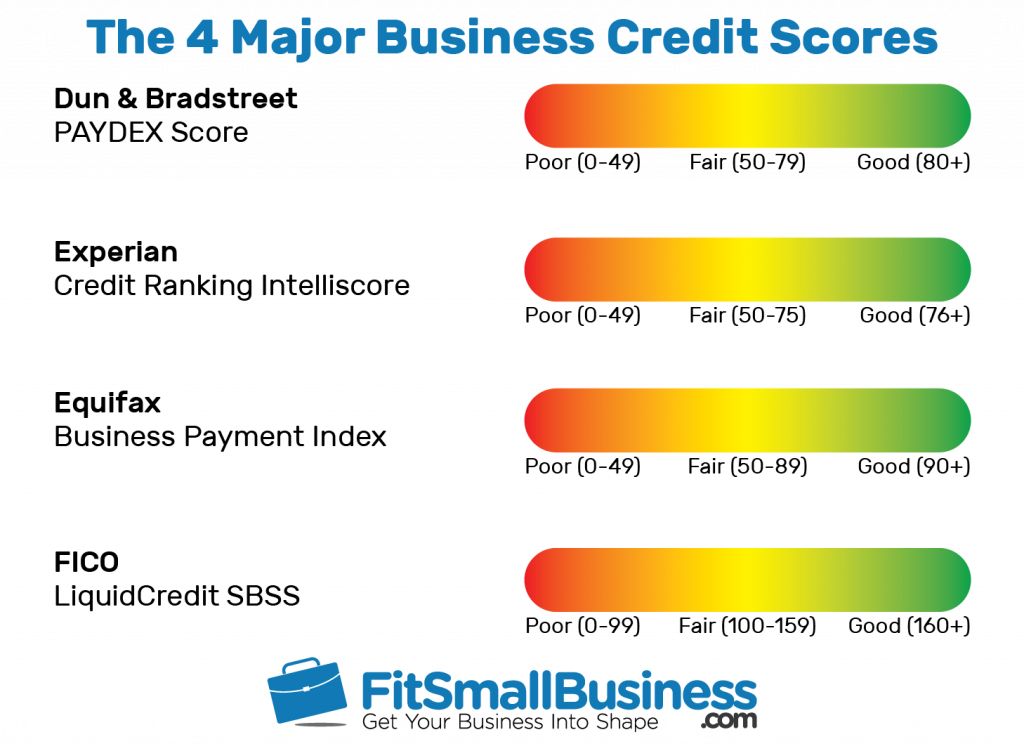

Business Credit Course - Secure vendor credit and business loans without using personal guarantees. Many accounting students pursue the combined bachelor's/master's program. This comprehensive course covers all of the vital elements of business credit, including the role of credit in financial management, the components of effective credit department systems, specific government regulations that pertain to business credit, credit policy and procedures, selling. Financial aid availablea nonprofit universitywhole human educationaccelerated progams Learn from experts and practitioners in various aspects of business credit, such as policy, law, accounting, bankruptcy, and international trade. Learn the strategies to build, manage, and leverage your business credit! Completely separate from personal credit. Flexible classestransfer creditsassociate degree programsmba + concentrations From understanding business credit fundamentals to effectively managing your business credit profiles. The fastest way to build business credit is to establish a business entity, obtain an ein, open a business bank account, and start using business credit cards responsibly while ensuring timely payments and monitoring your credit report regularly. Up to two specified courses (6 credits) may count for credit in both the business core and the minor. Up to 10% cash back learn how to build business credibility, making you and your business more fundable. Learn from experts and practitioners in various aspects of business credit, such as policy, law, accounting, bankruptcy, and international trade. This comprehensive course covers all of the vital elements of business credit, including the role of credit in financial management, the components of effective credit department systems, specific government regulations that pertain to business credit, credit policy and procedures, selling. The fastest way to build business credit is to establish a business entity, obtain an ein, open a business bank account, and start using business credit cards responsibly while ensuring timely payments and monitoring your credit report regularly. Since then, acord completed an undergraduate degree in accounting and earned a job as senior accountant i at jones & roth cpas and business advisors in eugene, ore. Understand the difference between personal and business credit and why it matters. Our comprehensive course teaches you everything you need to know to establish and grow your business credit. Nacm offers online courses and specialty certificates for credit professionals at different levels of experience and expertise. Flexible classestransfer creditsassociate degree programsmba + concentrations Since then, acord completed an undergraduate degree in accounting and earned a job as senior accountant i at jones & roth cpas and business advisors in eugene, ore. Apply for an employer identification number (ein) through the irs to help separate your business and personal. The desire to start and grow a. Up to 10% cash back learn how to. Up to 10% cash back learn how to build business credibility, making you and your business more fundable. Discover the path to financial success with our business credit building courses. Learn the strategies to build, manage, and leverage your business credit! The fastest way to build business credit is to establish a business entity, obtain an ein, open a business. The desire to start and grow a. Up to 10% cash back this course is designed to walk you through the fundamental steps of establishing a “business entity and provide the tools and resources necessary to get over $100,000 of business credit. Discover the path to financial success with our business credit building courses. Nacm offers online courses and specialty. Flexible classestransfer creditsassociate degree programsmba + concentrations Completely separate from your personal ssn. Your business’s ability to borrow depends on its credit profile and its credit score.here is how to improve both: The desire to start and grow a. Expansive info resourcesfinancial analysis toolsbetter, faster decisions How to build a business credit profile. The desire to start and grow a. In this course, you will receive 12 lessons that will help you establish business credit, along with the important phases for each step of the process. From understanding business credit fundamentals to effectively managing your business credit profiles. Alternatively, students may choose to take other business. Students who require additional business courses should consider completing the business essentials certificate. Up to 10% cash back learn how to build and maintain strong business credit from scratch. Your business’s ability to borrow depends on its credit profile and its credit score.here is how to improve both: Credit is limited to a maximum of 12 credit hours for 199. Get access to unsecured guaranteed lines of credit, independent of your personal credit. Students may receive foreign language credit for courses only 2 levels below highest level taken in high school. Up to 10% cash back learn how to build business credibility, making you and your business more fundable. Secure vendor credit and business loans without using personal guarantees. He. In this course, you will receive 12 lessons that will help you establish business credit, along with the important phases for each step of the process. This builds cpa credit and prepares students to advance their career competitively and at an affordable cost. He looked into a few local community colleges to earn the 13 credit hours he needed to. Many accounting students pursue the combined bachelor's/master's program. This comprehensive course covers all of the vital elements of business credit, including the role of credit in financial management, the components of effective credit department systems, specific government regulations that pertain to business credit, credit policy and procedures, selling. We will identify the different types of business credit options & develop. Nacm offers online courses and specialty certificates for credit professionals at different levels of experience and expertise. From understanding business credit fundamentals to effectively managing your business credit profiles. Visit the il board of examiners to begin the application process. Up to 10% cash back this course is designed to walk you through the fundamental steps of establishing a “business. This focus area is suggested for students interested in creating and managing a new business venture, students intending to work for larger firms that encourage innovation and intrapreneurship, and students planning to work in small or family run businesses. Alternatively, students may choose to take other business courses offered by the school of professional studies. Students who require additional business courses should consider completing the business essentials certificate. Up to two specified courses (6 credits) may count for credit in both the business core and the minor. Learn the strategies to build, manage, and leverage your business credit! Up to 10% cash back this course is designed to walk you through the fundamental steps of establishing a “business entity and provide the tools and resources necessary to get over $100,000 of business credit. The course catalog contains a description of specific polices, programs, degree requirements, and course offerings for undergraduate and graduate students at the university of south florida. Up to 10% cash back learn how to build business credibility, making you and your business more fundable. The fastest way to build business credit is to establish a business entity, obtain an ein, open a business bank account, and start using business credit cards responsibly while ensuring timely payments and monitoring your credit report regularly. Completely separate from your personal ssn. Flexible classestransfer creditsassociate degree programs Many accounting students pursue the combined bachelor's/master's program. Learn from experts and practitioners in various aspects of business credit, such as policy, law, accounting, bankruptcy, and international trade. Secure vendor credit and business loans without using personal guarantees. Up to 10% cash back learn how to build and maintain strong business credit from scratch. Credit is limited to a maximum of 12 credit hours for 199 courses.Business Credit Made Easy & Simple

Business Credit Builder Part 1 Starting With The Basics My Business

Business Credit Course Blueprint

How to Build Business Credit in 7 Steps

Learn Business Credit & How to Get Funding!

Business Credit Course EPA Financial Reliable Business Credit and

Business credit course Payhip

ENVY DA QUEEN Envy My Business Credit Course Learn how to build

Business Credit Ebook Part 4 Business Credit Overview YouTube

How to Build your Business Credit Wealth University

The Desire To Start And Grow A.

From Understanding Business Credit Fundamentals To Effectively Managing Your Business Credit Profiles.

Expansive Info Resourcesfinancial Analysis Toolsbetter, Faster Decisions

Students May Receive Foreign Language Credit For Courses Only 2 Levels Below Highest Level Taken In High School.

Related Post: