Aftr Course

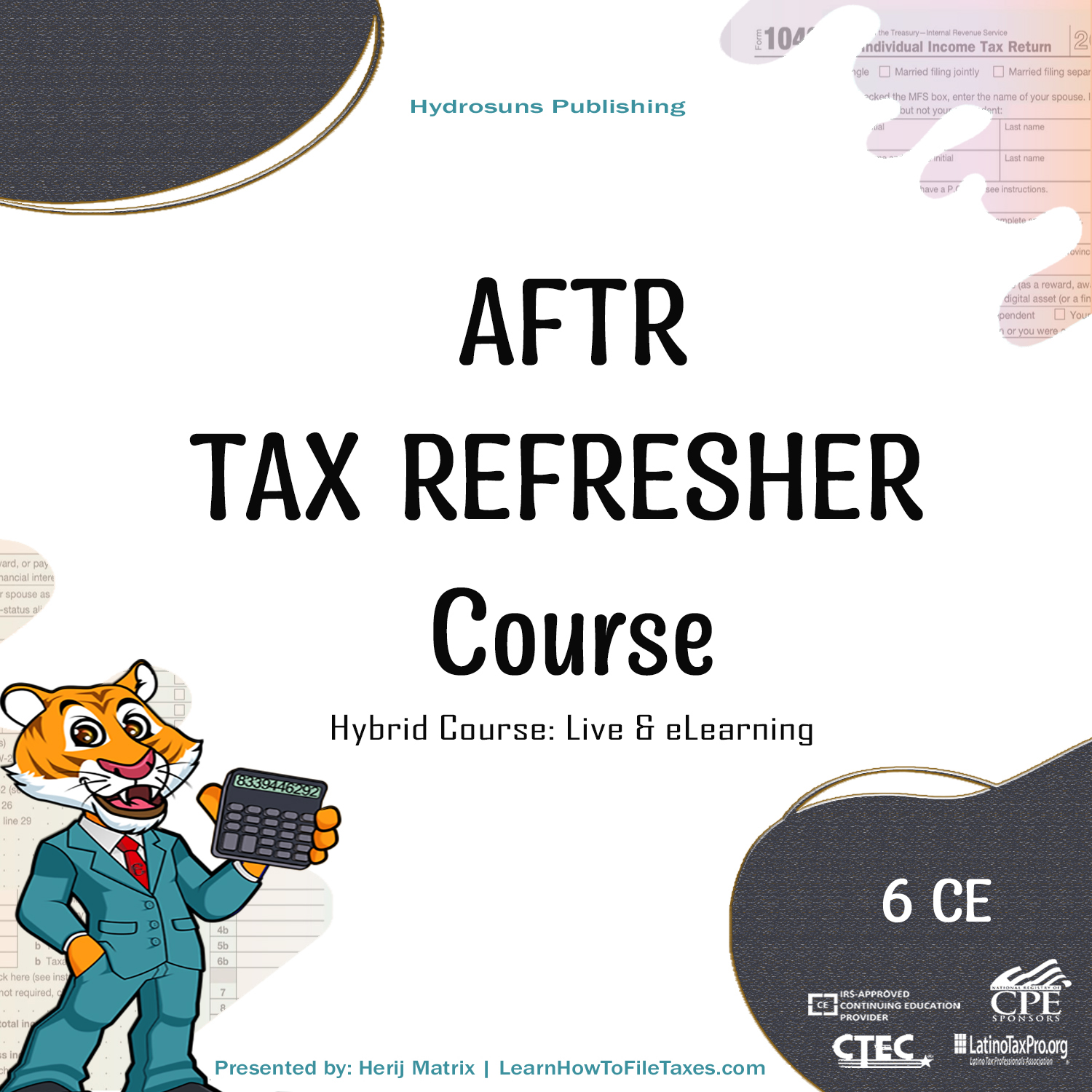

Aftr Course - Learn about the aftr course and test requirements, deadlines, exemptions, and review process for tax professionals. Learn how to prepare personal income tax returns, small business and depreciation, business entities and advanced topics with aftr. *course material should only include the subject areas on the aftr course outline. Ce information for registered tax return preparers and ce providers. The annual federal tax refresher (aftr) is part of the voluntary irs annual filing season program (asfp). Event starts on monday, 8 july 2024 and happening at hyatt. This course provides the information necessary to pass our aftr exam and obtain the afsp — record of completion, which is included in the materials. Learn the latest tax law updates and best practices for preparing individual 2024 tax returns in 2025. New legislation enacted after the publication of this outline may be voluntarily incorporated into the. Event in chicago, il by national association of tax professionals (natp) on wednesday, july 30 2025 Ce information for registered tax return preparers and ce providers. Learn the latest tax law updates and best practices for preparing individual 2024 tax returns in 2025. Learn how to prepare personal income tax returns, small business and depreciation, business entities and advanced topics with aftr. Natp aftr workshop | chicago, il | july 8, 2024 hosted by national association of tax professionals (natp). *course material should only include the subject areas on the aftr course outline. Find out how to offer, take, and get credit for t… The annual federal tax refresher (aftr) is part of the voluntary irs annual filing season program (asfp). Event starts on monday, 8 july 2024 and happening at hyatt. New legislation enacted after the publication of this outline may be voluntarily incorporated into the. Platinum tax school offers online tax courses with. This course provides the information necessary to pass our aftr exam and obtain the afsp — record of completion, which is included in the materials. Platinum tax school offers online tax courses with. The annual federal tax refresher (aftr) is part of the voluntary irs annual filing season program (asfp). Ce information for registered tax return preparers and ce providers.. This course provides the information necessary to pass our aftr exam and obtain the afsp — record of completion, which is included in the materials. New legislation enacted after the publication of this outline may be voluntarily incorporated into the. Natp aftr workshop | chicago, il | july 8, 2024 hosted by national association of tax professionals (natp). Event starts. This course provides the information necessary to pass our aftr exam and obtain the afsp — record of completion, which is included in the materials. Event in chicago, il by national association of tax professionals (natp) on wednesday, july 30 2025 Event starts on monday, 8 july 2024 and happening at hyatt. New legislation enacted after the publication of this. During our live and interactive annual federal tax refresher (aftr) workshops, your instructor will highlight the changes and complex topics you need to know to pass the aftr exam and. Find out how to offer, take, and get credit for t… Natp aftr workshop | chicago, il | july 8, 2024 hosted by national association of tax professionals (natp). Ce. Ce information for registered tax return preparers and ce providers. *course material should only include the subject areas on the aftr course outline. The annual federal tax refresher (aftr) is part of the voluntary irs annual filing season program (asfp). Find updated course outline, test. Event in chicago, il by national association of tax professionals (natp) on wednesday, july 30. Learn about the aftr course and test requirements, deadlines, exemptions, and review process for tax professionals. Learn the latest tax law updates and best practices for preparing individual 2024 tax returns in 2025. *course material should only include the subject areas on the aftr course outline. Event starts on monday, 8 july 2024 and happening at hyatt. Find updated course. Ce information for registered tax return preparers and ce providers. Platinum tax school offers online tax courses with. *course material should only include the subject areas on the aftr course outline. Learn about the aftr course and test requirements, deadlines, exemptions, and review process for tax professionals. Find updated course outline, test. This course provides the information necessary to pass our aftr exam and obtain the afsp — record of completion, which is included in the materials. Event starts on monday, 8 july 2024 and happening at hyatt. New legislation enacted after the publication of this outline may be voluntarily incorporated into the. *course material should only include the subject areas on. Find updated course outline, test. Natp aftr workshop | chicago, il | july 8, 2024 hosted by national association of tax professionals (natp). The annual federal tax refresher (aftr) is part of the voluntary irs annual filing season program (asfp). Event in chicago, il by national association of tax professionals (natp) on wednesday, july 30 2025 Find out how to. New legislation enacted after the publication of this outline may be voluntarily incorporated into the. Learn the latest tax law updates and best practices for preparing individual 2024 tax returns in 2025. This course provides the information necessary to pass our aftr exam and obtain the afsp — record of completion, which is included in the materials. Event starts on. Learn about the aftr course and test requirements, deadlines, exemptions, and review process for tax professionals. The annual federal tax refresher (aftr) is part of the voluntary irs annual filing season program (asfp). Learn the latest tax law updates and best practices for preparing individual 2024 tax returns in 2025. Learn how to prepare personal income tax returns, small business and depreciation, business entities and advanced topics with aftr. Event starts on monday, 8 july 2024 and happening at hyatt. *course material should only include the subject areas on the aftr course outline. Event in chicago, il by national association of tax professionals (natp) on wednesday, july 30 2025 Find updated course outline, test. Ce information for registered tax return preparers and ce providers. This course provides the information necessary to pass our aftr exam and obtain the afsp — record of completion, which is included in the materials. Platinum tax school offers online tax courses with. New legislation enacted after the publication of this outline may be voluntarily incorporated into the.Everything You Need to Know About the 2023 IRS Annual Federal Tax

2024.07.09 Broadcast Start today! AFTR Course Available Now

Learn How To File and Prepare Taxes

Aftr & Visit Ljubljana

AVAILABLE JUNE 2025 Annual Federal Tax Refresher (AFTR) (Course and

CA Tax Law 5 hours AVAILABLE MARCH 2025 Tax IQ Academy

Fillable Online weblearn ox ac CE Provider FAQs Annual Federal Tax

Now Available DrakeCPE 2023 AFTR Course! Taxing Subjects

approved_rpo_aftr_course_outline PDF Cost Of Living Tax Deduction

6Hour Annual Federal Tax Refresher (AFTR) Course The Tax School

Find Out How To Offer, Take, And Get Credit For T…

Natp Aftr Workshop | Chicago, Il | July 8, 2024 Hosted By National Association Of Tax Professionals (Natp).

During Our Live And Interactive Annual Federal Tax Refresher (Aftr) Workshops, Your Instructor Will Highlight The Changes And Complex Topics You Need To Know To Pass The Aftr Exam And.

Related Post: